A not directly observed but solved for implicitly

SOLOW MODEL

- NX = 0, G = 0

- production function constant returns to scale

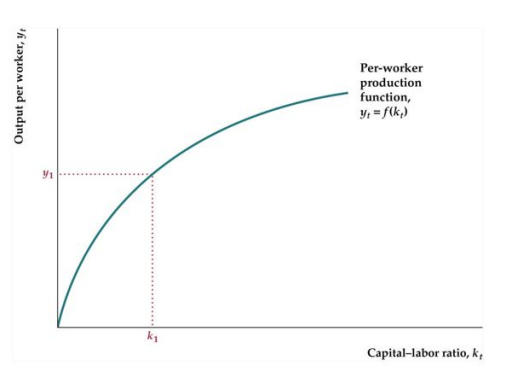

Capital-Labor ratio

Production Function: (per worker)

diminishing MPK

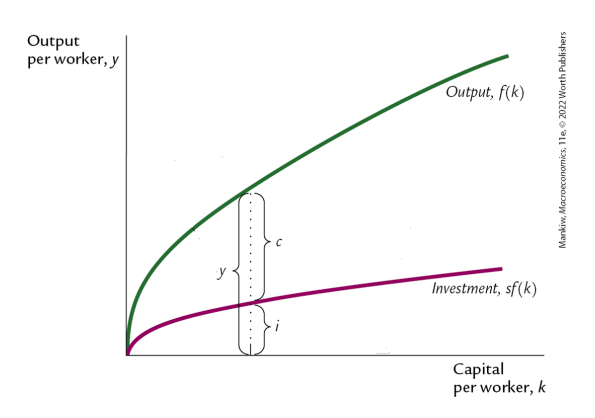

Aggregate demand (per worker):

Savings where s is saving rate

investment(per worker):

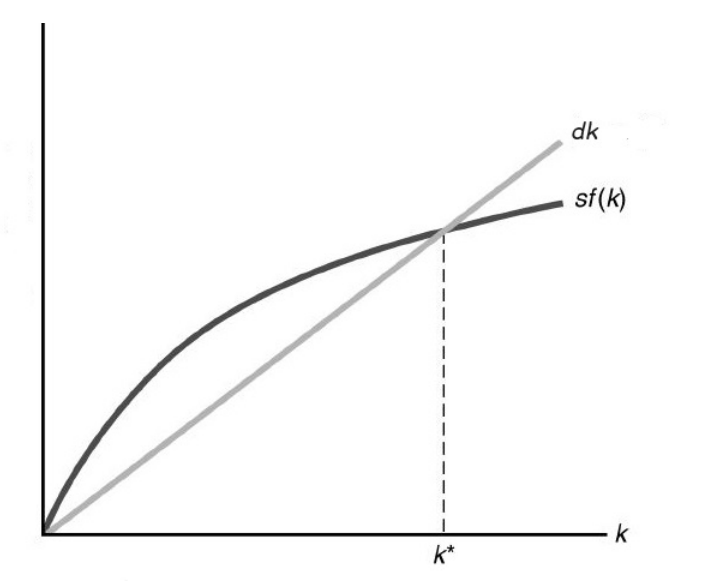

Capital stock next period (Capital Accumulation Equation):

steady state occurs when , where is the steady state

- intersection of these two curves

Golden Rule capital labor ratio (maximizes consumption per worker): maxed when

Adding population growth

Capital Accumulation Equation:

Solow Model with Pop Growth:

Steady state at:

at steady state:

higher decreases at steady state

Golden Rule Capital-Labor Ratio:

COMPARATIVE STATICS

initially at steady state so no change, after savings increases increases, then back to steady state

-

higher savings rate has level effect not growth effect

-

positive relationship between savings rate and income per capita

therefore also lower output per worker -this is just one relationship:

- obviously this is not entirely accurate because it ignores contribution to pension, innovation, tech advancement, higher pop growth means more scientists, inventors, engineers…

Case Studies

War: (ceteris paribus) decline in K:

- k and y fall, high growth as decline in population: : k will decrease down to k* period of contraction

Productivity Change: assuming production function shifts up. and remains at higher level steady state: (one time effect)

this is the same effect as

Balanced Growth

- Y, K, C grow at same rate

- steady state exhibits this as they all grow at

- balanced growth implies (capital-output ratio) is constant

Convergence

- Solow model predicts conditional convergence

- converge if same steady state

AK Model/Endogenous Growth

Prod. same per worker

- constant returns to scale

MPK constant (not diminishing)

Supply of Goods and Services:

Demand for Goods and Services:

Given fixed saving rate:

Capital Accumulation Equation

essentially no steady steady state

Growth rate of

will grow forever if

savings rate affects long run growth rate of output

Growth Policies

”best” savings rate is golden rule, US is not saving enough

Policies to incentivize private savings:

- lower tax, which :

- small effect due to effect on lifetime income Policies to increase Government savings

- raise taxes or cut spending

- spending hard to reduce

- won’t effect natl. savings under Ricardian Eq.

countries have to endure a decline in consumption before reaching the golden rule steady state

Policies to raise productivity:

- improve infrastructure

- net-zero effect due to crowding out private investment

- build human capital

- education, worker training and relocation programs, health programs

- R&D

- grants, funding gov research, tax incentives, support for scientific education

Additional Considerations

Institutions

real income per capita correlated with institutional quality improvements in institutional quality reduce growth volatility good institutions have regulatory framework to protect investors → promotes investment

Free Trade

geographic differences can be used to study because they are correlated with trade and not other stuff

Trade/GDP GDP per capita

- trade gives access to foreign tech, know-how, and investment

- comparative advantage

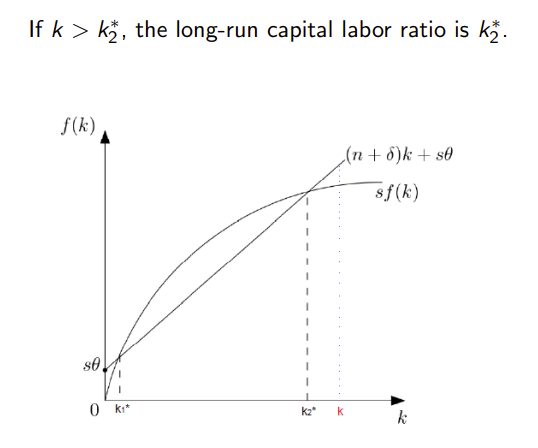

Poverty Trap

each period there is fixed amount of income that must be consumed between 0 and 1

cap accumulation:

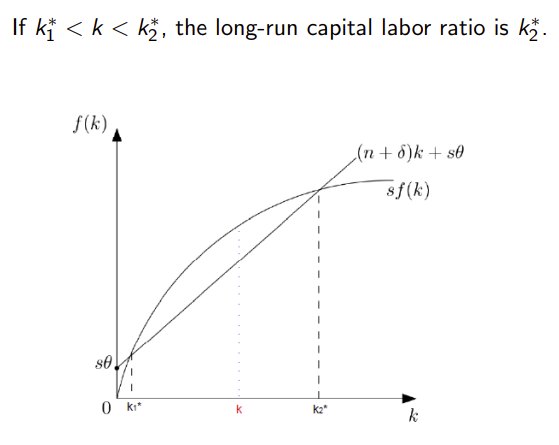

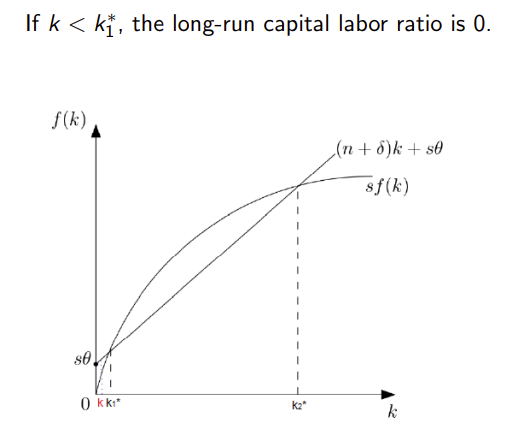

Steady States:

- no intersection

- no steady state

- tangent

- one steady state

- two steady states

countries that start poor will remain poor

Policy to break this trap:

big-push - increased aid and investment from foreign countries