Investment

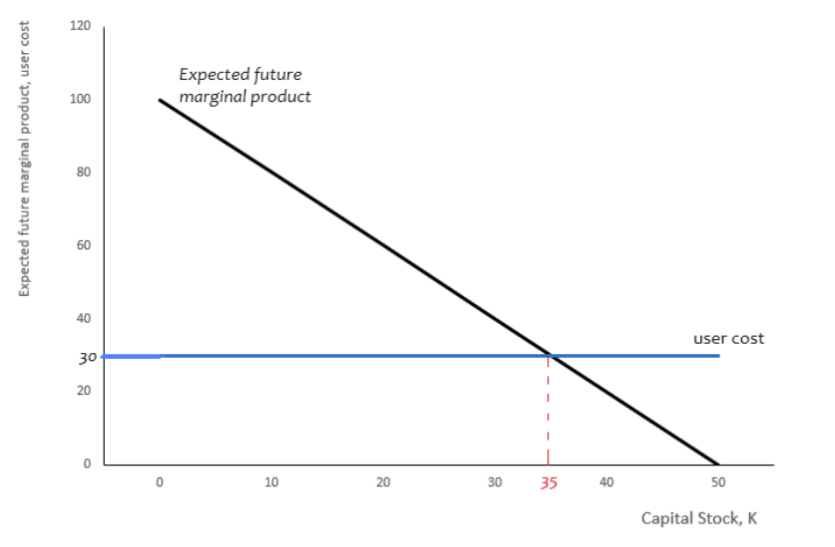

- cost benefit decision to additional unit of = MPK

- investment becomes K with lag

User Cost of Capital: interest cost + deprecation

Increase K

Decrease K

Desired Capital Stock ()

downward sloping; is constant

Factors that affect

- Technological changes

Factors that affect

- changes in the

- Taxes

Desired Investment

Desired Investment = net increase in K + investment needed to replace depreciated capital

With Corporate Taxes

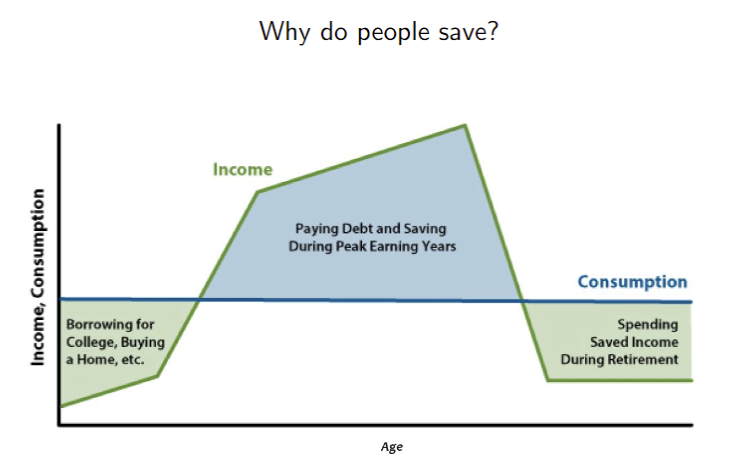

Savings and Consumption

Saving allows for consumption smoothing

Budget Constraint

- lifetime wealth:

- price of current consumption determined by

Consumption smoothing:

Marginal Propensity to Consume:

- fraction of additional income a person consumes in current period

estimated between 0 and 1

Savings in Period 1:

Factors that affect consumption and savings

opposite IE for savers and borrowers, SE + IE make it ambiguous

- empirically slightly

Lump-Sum Tax

BC:

lump sum tax does not affect individuals BC

Ricardian Equivalence

has to be balanced by future tax increases lump-sum tax cuts do not affect

National Savings

Private Savings =

Gov Savings =

National Savings: