Monetary Policy Implementation

Federal Funds Rate (FFR): interest rate for overnight lending between banks

- FFR set during FOMC meeting (every 6 weeks)

FFR ≠ Discount Rate

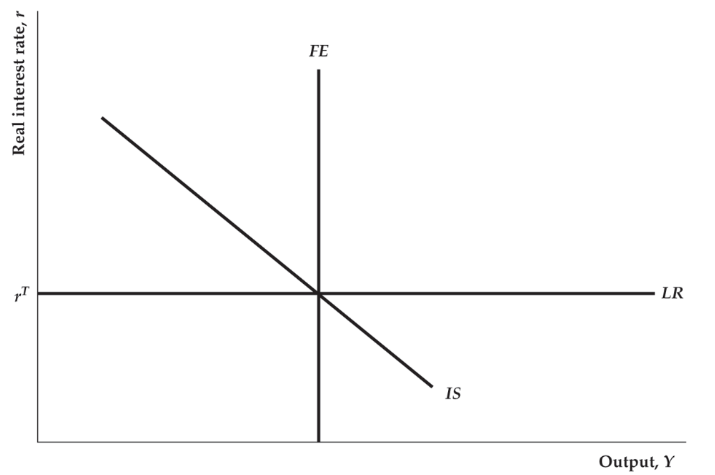

LR Curve: represents under Fed policy

The Fed adjusts to hit

Shock Takeaways

Shocks to LM curve

- Fed stabilizes by maintaining same FFR target

Shocks to IS curve

- Fed needs to change target interest rate to stabilize output

- Substantial uncertainty about optimal FFR target

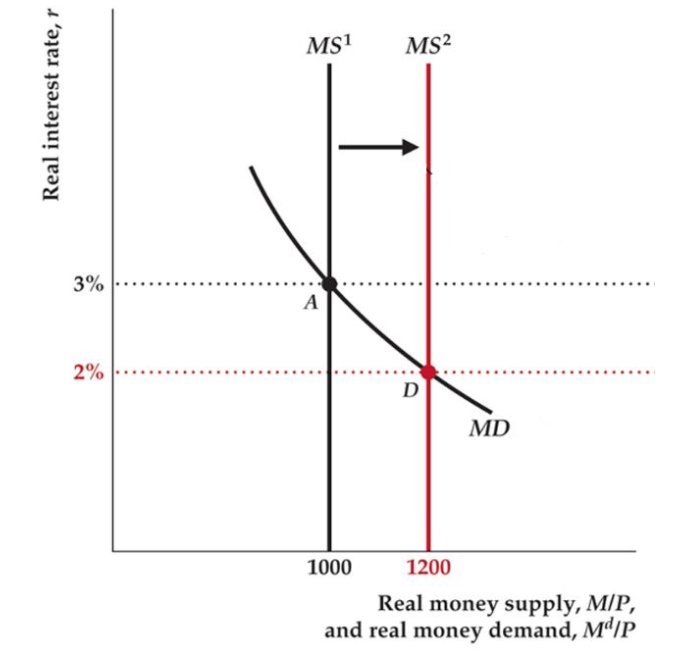

Why target FFR instead of M1?

Money demand changes frequently

- Would have to adjust M1 to maintain Money Market equilibrium

- FFR allows Fed to maintain same target

- works better to offset shocks to money demand

Why is it difficult to set the interest rate target?

- conflicting signals about state of economy

- lag in monetary policy (long and variable)

- Zero lower bound

Taylor Rule:

where:

: nominal FFR

: inflation rate over last 4 quarters

: equilibrium (usually assumed to be 2%)

: output gap = : % deviation of from

: is the weight; how much the Fed cares about inflation vs output (0.5 is neutral)

Fiscal Policy Implementation

- long lags due to political process

- lack in flexibility (gov committed years in advance)

- difficult to predict effects/size necessary stimulus compared to monetary policy

Automatic Stabilizers

Features of the structure of government budgets that act to dampen fluctuations in real GDP

e.g. Unemployment insurance, income tax, welfare programs

Government Budget Deficit

Deficit: when exceeds in any fiscal year

Debt: total amount of money owed by government to creditors at a particular time

Debt-GDP ratio:

low deficit relative to GDP debt-GDP ratio

high rate of GDP growth debt-GDP ratio

where:

: nominal value of government debt

: price level

: real GDP