Key assumption:

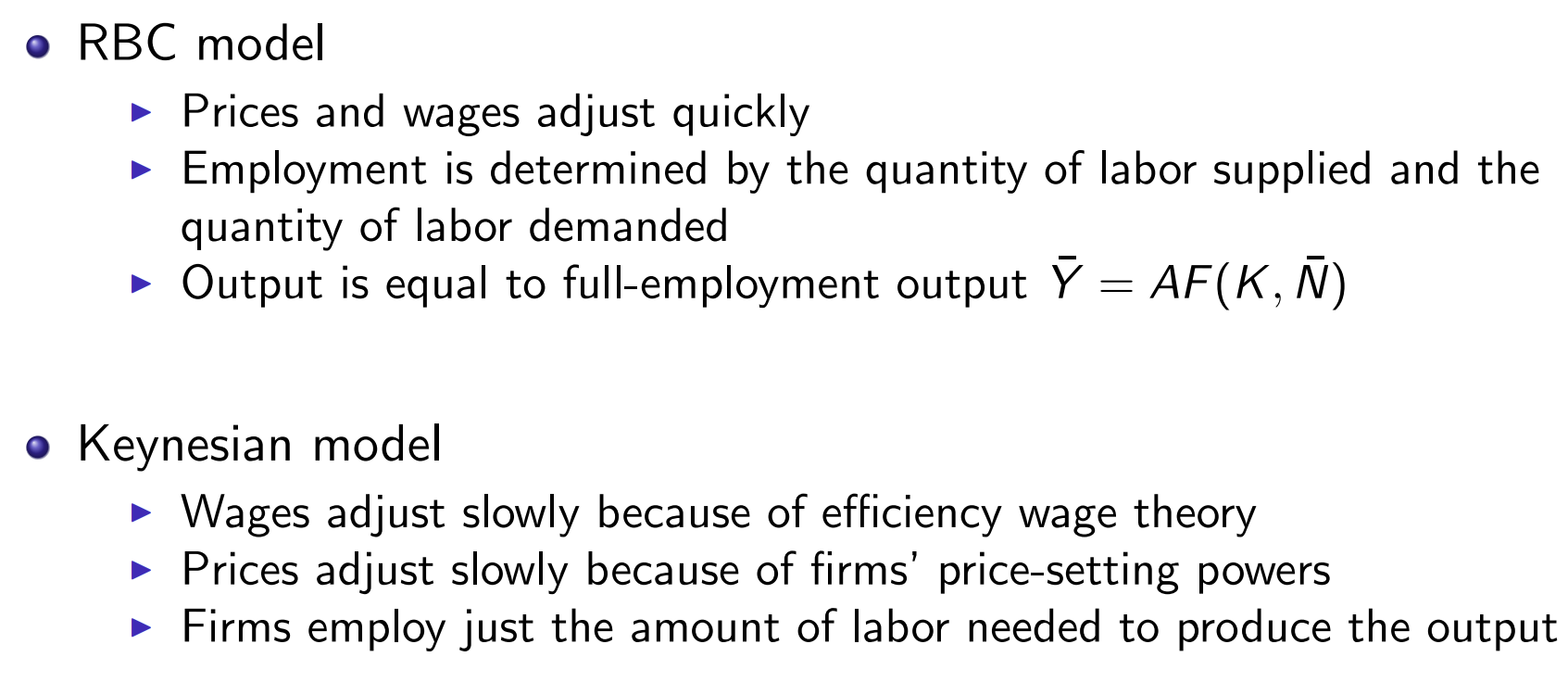

- Wages and prices are “rigid” or “sticky” and do not adjust quickly to market-clearing levels

- Business cycles are primarily caused by shocks to the aggregate demand

- Wages adjust slowly because of efficiency wage theory

- Prices adjust slowly because of firms’ price-setting powers

- Firms employ just the amount of labor needed to produce the output

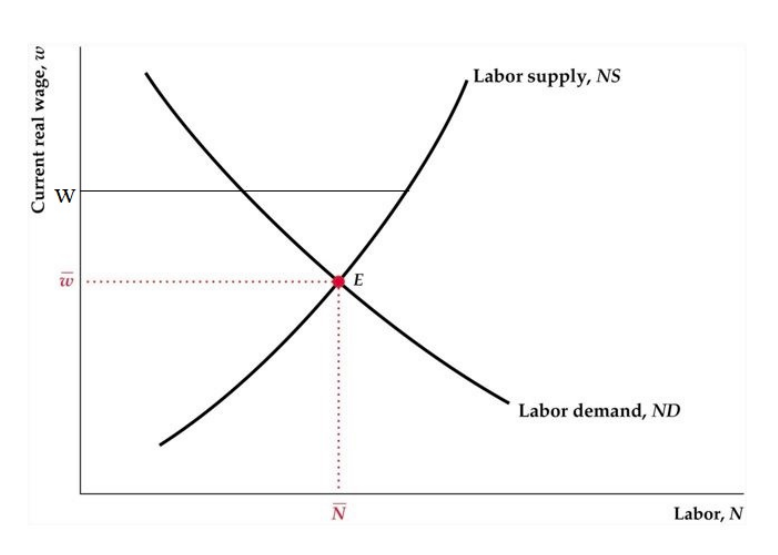

Wage Rigidity

real wage moves too little to equate and

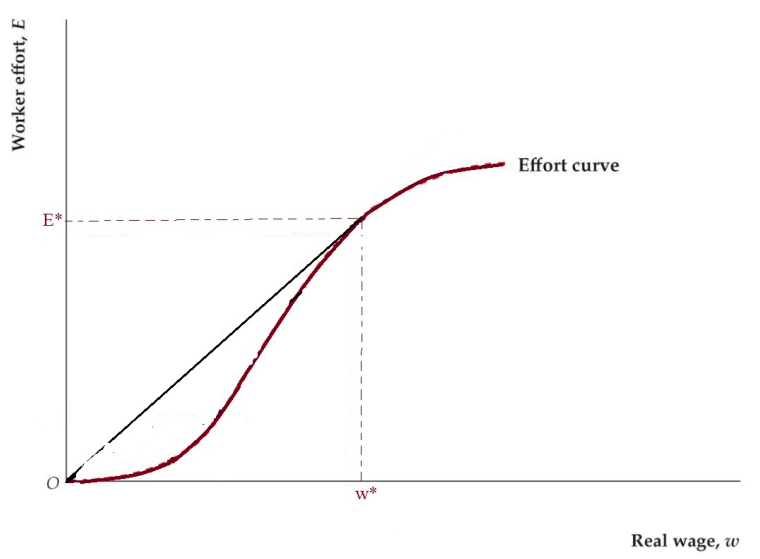

Efficiency wage model

Higher wage desire to keep job effort

Higher wage employer-employee relations effort

at tangency point maximizes or effort per dollar paid

given the firm chooses based on

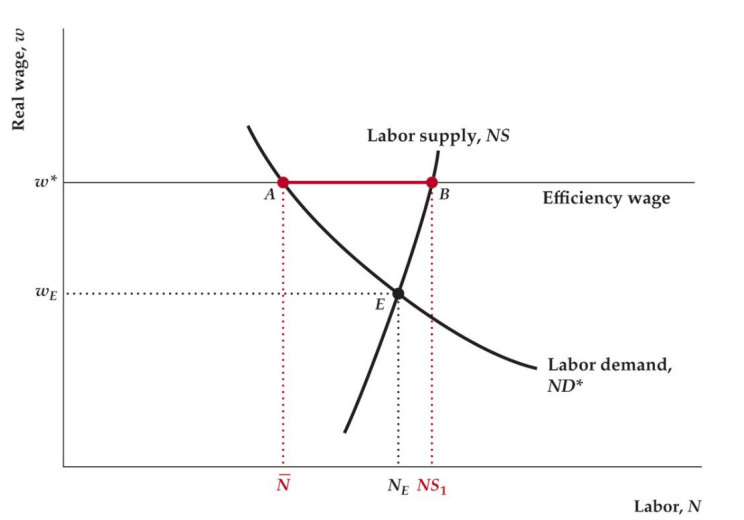

Unemployment

if unemployment occurs

Unemployment given by difference in (A) and (B) at efficiency wage level ()

During recessions so Unemployment

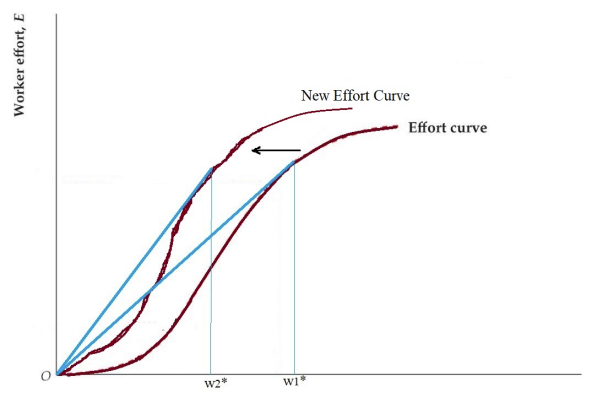

Empirically real wage is procyclical

- effort changes in recessions

People work harder because they are more concerned about losing their jobs

Employment depends on not if efficiency wage > market clearing wage

Price Rigidity

In perfectly comp firms are price takers

- P = MC

In monopolistic comp firms set prices w/ markup

- P > MC

there are costs to changing prices (menu costs) empirically most firms do not change prices frequently

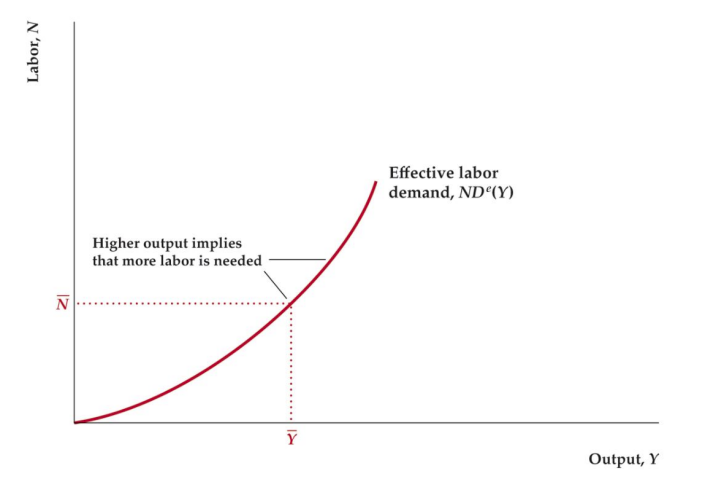

Effective Labor Demand Curve

Firms choose labor based on output

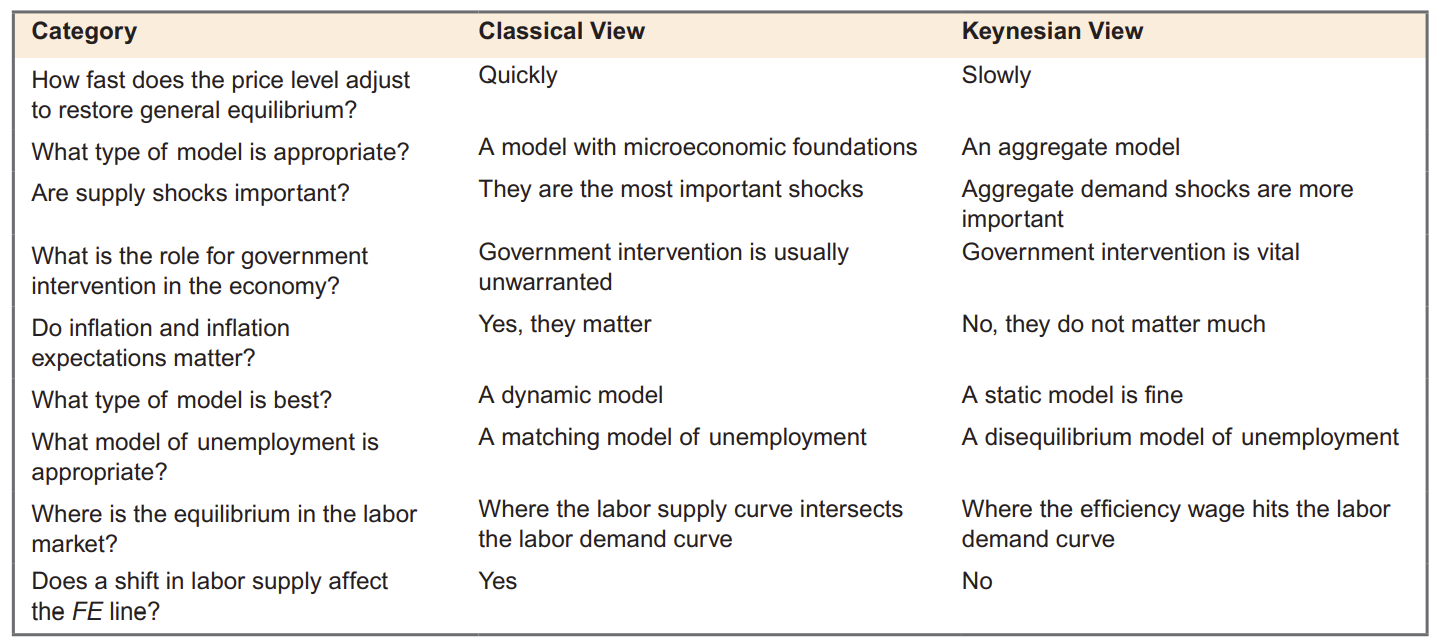

Summary of Differences

Labor Productivity

- The fact that average labor productivity is empirically procyclical is not explained by Keynesian model

adjustment with utilization

average labor productivity may fall during recessions if labor is utilized less intensively

Monetary Policy

GIVEN :

| Variable | RBC (no misperception) | Keynesian (SR) | Keynesian (LR) |

|---|---|---|---|

| Y | - | - | |

| - | - | ||

| C | - | - | |

| I | - | - | |

| N | - | - | |

| P | - |

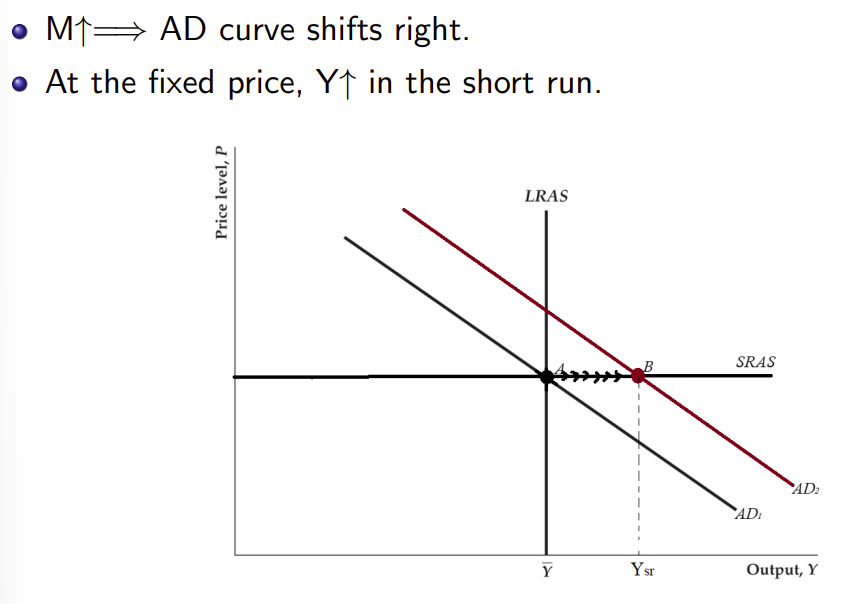

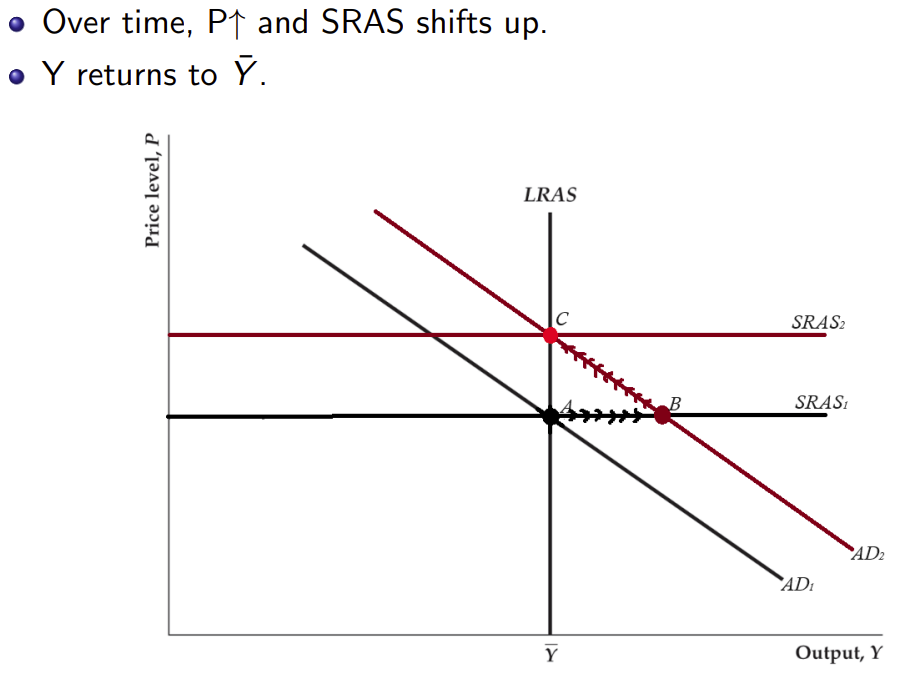

Monetary Policy not neutral in SR

- menu costs → firms don’t react to increased demand by raising prices, instead increase production to meet higher demand

- temporarily

Fiscal Policy

GIVEN :

| Variable | RBC (no misperception) | Keynesian (SR) |

|---|---|---|

| - | ||

| Y | ||

| N | ||

| P | - |

Government Spending Multiplier

- The SR change in Y from a one-unit change in G

- Multiplier =

- Keynesians argue it is greater than 1

- raises income of consumers so

Lump Sum Tax-Cut

Government Spending multiplier not present here instead it is the tax multiplier which may not be greater than 1

- When G ↑, ∆Y = ∆C + ∆G

- When T ↓, ∆Y = ∆C

Summary

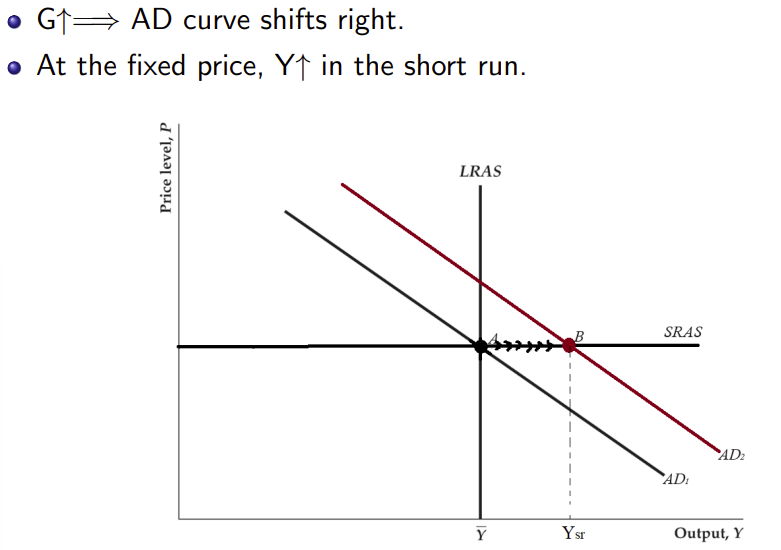

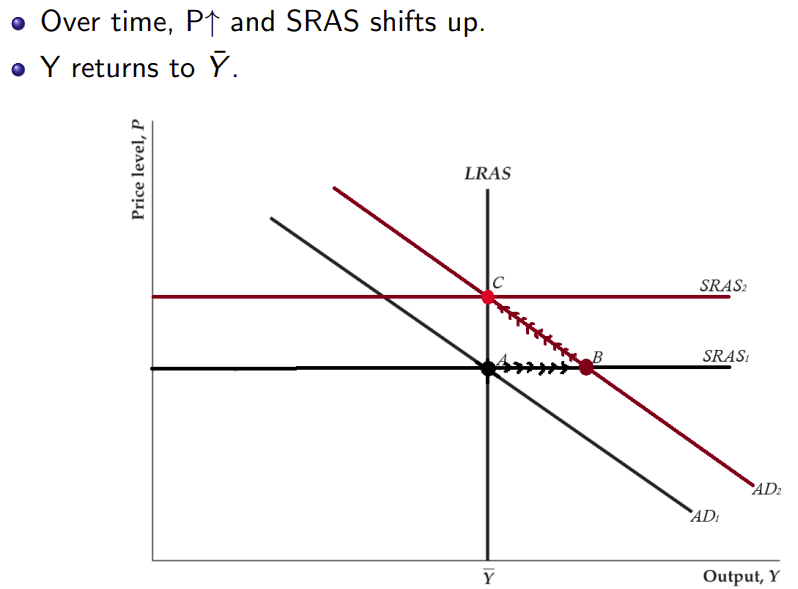

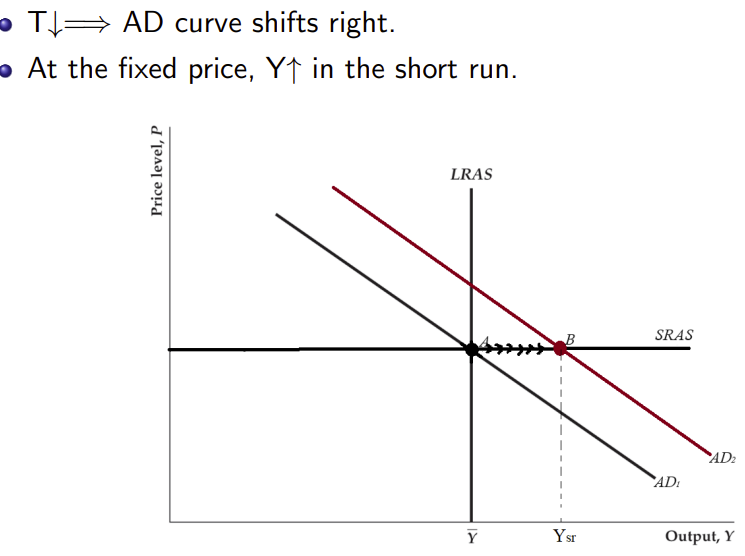

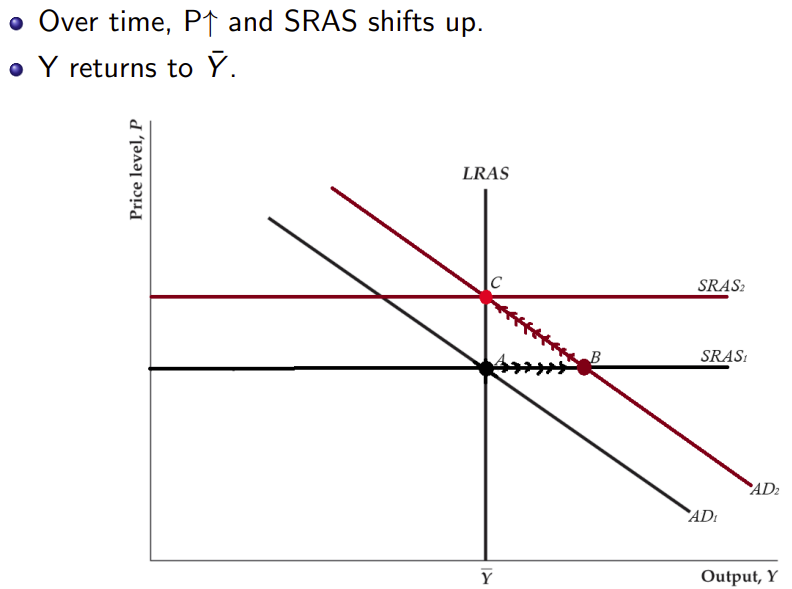

- In the Keynesian model, G ↑ or T ↓ will increase Y in SR

- Y deviates from the full-employment output due to an increase in aggregate demand

- The government spending multiplier is greater than the tax multiplier

Macroeconomic Stabilization and Demand shocks

- Do nothing: economy corrects itself but possibly slow price adjustment process, output and employment remain below their full-employment levels.

- ↑: LM shifts to the right and the economy could return to general equilibrium faster

- G ↑: IS shifts to the right and the economy could return to general equilibrium faster